20+ Ltv ratio calculator

Or enter C and D to find A and B The calculator will simplify the ratio A. Click the Customize button above to learn more.

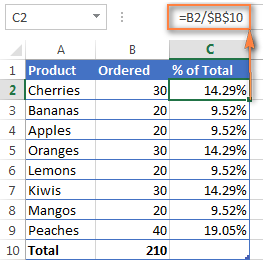

How To Calculate Percentage In Excel Percent Formula Examples

If you put 20 down on a 200000 home that 40000 payment would mean the home still has 160000 of debt against it giving it.

. Compare Quotes See What You Could Save. Mortgage insurance is optional but your mortgage lender may require you to obtain. Otherwise the calculator finds an equivalent ratio by multiplying each of A and B by 2 to.

The remaining 20 must be paid out of your pocket. Loan-to-value LTV is the ratio of. That means your LTV is 80 percent and your deposit is 20 percent so you should look for an 80 percent LTV mortgage deal.

Mortgage Loan 320000. Then multiply the result by 100 to express the LTV as a percentage. The formula to calculate LTV is.

This ratio calculator will accept integers decimals and scientific e notation with a limit of 15 characters. The lowest LTV ratio is achieved due to lower real estate value and higher initial own contribution. LTV Ratio 80.

So by evaluating the LTV lenders try to figure out whether the borrower can. Our Loan-to-Value LTV Ratio Calculator helps you estimate how much you owe on your mortgage compared to your homes current market value. For instance lets assume you own a home that costs 300000 and your current mortgage balance was 240000.

Get Your Best Interest Rate for Your Mortgage Loan. What is a good loan to value ratio. On a 500000 home only 15000 5000003 is required as a down payment.

You only have to enter two components to learn your loan to value. Find out your loan-to-value LTV ratio and check your eligibility for a new mortgage refinancing or a home equity line-of-credit HELOC. Loan amountappraised value of asset x 100 LTV For example if you borrow 25000 to buy a 25000 car your LTV will be 2500025000 x 100 or 100.

In terms of risk assessment a high loan to value ratio indicates a high risk that the debtor may not afford to pay back the debt in due time. Loan to Value LTV Calculator. Loan-to-value ratio LTV is the borrowed amount divided by the asset value you are purchasing or refinancing.

The following formula determines the LTV. Our Loan-to-Value LTV Ratio Calculator helps you estimate how much you owe on your mortgage compared to your homes current market value. LTV 08 x 100.

Key in the amount owed on your mortgage s. The other method to know loan to value is LTV calculator that can help you in calculating LTV. An LTV over 100 means you owe more on the loan than your vehicle is worth.

Choose the right currency if needed Input an estimate of your property value. This is equal to 08 which is 80 when multiplied by 100. Usually banks finance up to 80 percent to 90 percent of the LTV depending on the type of collateral and credit history of the borrower.

To calculate your LTV rate simply. LTV mortgage balance home value x 100. But perhaps you want to borrow more money than the car is worthsay you add the.

Its also often referred to as being upside down or underwater on your loan. Compare Quotes Now from Top Lenders. After you have entered this information in the form you simply click the Calculate button for instant results.

Besides using an LTV calculator you can also use the formula to calculate LTV. Usually the LTV ratio is less than 80. You can use this Loan to Value Calculator to calculate the loan-to-value LTV and cumulative loan-to-value CLTV ratios for your property.

LTV Mortgage amount Property value 100. You currently have a loan balance of 140000 you can find your loan balance on your monthly loan statement or online account and you want to take out a 25000 home equity line of credit. LTV Mortgage Amount Appraised property value.

Enter your estimated home value and your mortgage balance to calculate your loan-to-value information. Enter A and B to find C and D. The loan to value ratio calculator exactly as you see it above is 100 free for you to use.

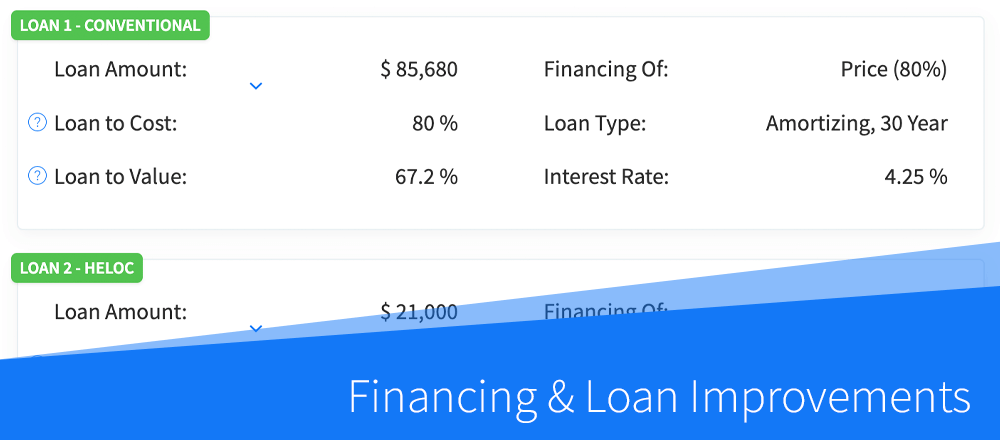

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Jumbo mortgages require an LTV ratio of 80 or lower which is a down payment of at least 20. If you get an 80000 mortgage to buy a 100000 home then the loan.

Loan to value is the ratio of the amount of the mortgage lien divided by the appraisal value of a property. Heres what your LTV ratio would be. Loan to Value LTV Ratio 320000 400000.

This is considered negative equity. How to calculate Loan-to-Value LTV. The LTV ratio also indicates how much equity you have in your home.

Conventional mortgages can allow for an LTV ratio of up to 97 or a downpayment as low as 3. The loan-to-value ratio is the amount of the mortgage compared with the value of the property. Your home currently appraises for 200000.

It is expressed as a percentage. Although this formula for calculating LTV isnt hard to understand but sometimes leads to an inaccurate result. You need to divide 200000 by 250000 to find out what your LTV is.

If you put 20 down on a 200000 home that 40000 payment would mean the home still has 160000 of debt against it giving it a LTV of 80. This value is good and means that the total mortgage is 80 of the total value of the house. The loan-to-value ratio commonly referred to as LTV is a comparison of your cars value to how much you owe on the loan.

The other 20 is paid from own funds and is part of the investors. Also known as conventional mortgages have a down payment greater than 20. LTV 240000300000 x 100.

The loan to value LTV ratio is 80 where the bank is providing a mortgage loan of 320000 while 80000 is your responsibility. Current combined loan balance Current appraised value CLTV. So using a loan value calculator is still a better option as it provides 100.

Ad Work with One of Our Specialists to Save You More Money Today. This online calculator is ideal for use with both home mortgage purchase and home mortgage refinance plans. The formula for LTV is.

The algorithm behind this LTV calculator applies the fomula explained here. Our Loan to Value LTV Calculator is easy to use. Down Payment 80000.

Ad Find Mortgage Lenders Suitable for Your Budget. Ad Calculate Your HELOC Amount Today.

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Kw5vcwxmxccu6m

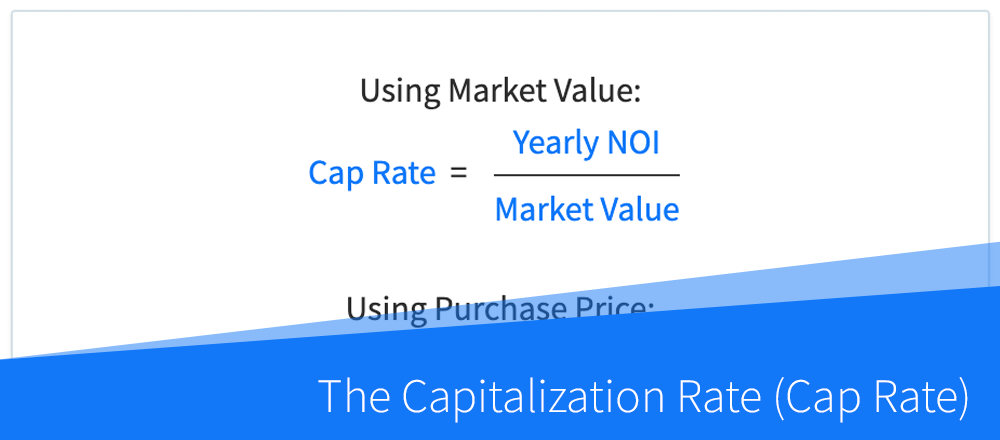

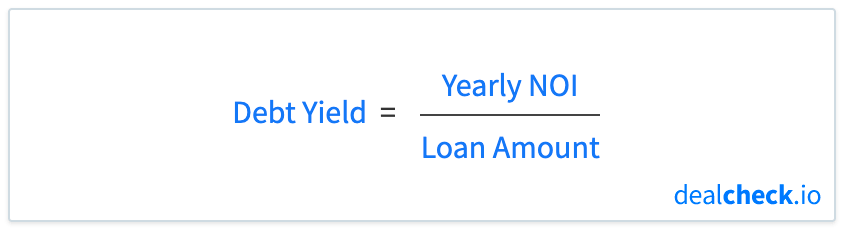

How To Calculate The Debt Yield In Commercial Real Estate Dealcheck Blog

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Loan To Value Ratio Ltv Formula And Example Calculation

Dealcheck Blog Dealcheck

Everything About Debt To Income Ratio And How To Calculate It

Customer Lifetime Value An Ultimate Guide

How To Calculate The Debt Yield In Commercial Real Estate Dealcheck Blog

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Have A Need For Financing Call Me Today To Discuss At 503 614 1808 Thebrokerlist Blog

Predictive Ltv

What Is An Amortization Schedule Use This Chart To Pay Off Your Mortgage Faster

Loan To Value Ratio Ltv Formula And Example Calculation

Calculate The Loan To Value Ltv Ratio Using Excel

Have A Need For Financing Call Me Today To Discuss At 503 614 1808 Thebrokerlist Blog